Equipment Depreciation

Everything you ever needed to know about equipment depreciation.

What is equipment depreciation?

Equipment depreciation (ED) tells you how much value a certain asset is losing over a year owing to its regular use.

Most of the physical assets you own are worth less now than when they were bought. Even the best-maintained equipment will eventually need to be replaced. Equipment depreciation is one of the factors that help you determine whether it’s more cost-effective to replace an asset or continue repairing it.

Say an asset costs you $11,000. Its useful life is estimated at five years. At the beginning of the 4th year, after using straight-line depreciation (we’ll explain it later), the asset is now worth $5,000. It experiences a major breakdown and you need to shell out $5k to repair it. Is that worth it?

ED is helpful here because it provides you with the current value of your assets. When older assets break down, an allocation of funds for new ones might be a wiser move than spending money on repairs, especially if it’s more money than the asset itself is worth at that time.

All of that being said, the main purpose of depreciation lies in the field of taxes. You are typically eligible to write off (or “depreciate”) part of the cost of assets over a period of time. Among other things, this means saving money on maintenance expenses at the end of the financial year.

Which assets can be depreciated?

Not every asset you own can be depreciated. Certain low-cost items (typically, with short lifespans) can be recorded as business expenses and are written off the same year as they were incurred. So which assets can be depreciated?

The IRS rules dictate which of your assets are depreciable. According to the IRS Publication 946, in order to qualify as a depreciable asset for tax purposes, the property must meet the following requirements:

- You must be the owner of the asset

- You must use it in your business for income-producing activities

- The asset must have a useful life of at least two years

In heavy industries like manufacturing and construction, the majority of assets will satisfy the above criteria.

Checklist for Creating a Preventive Maintenance Plan

Following a consistent Preventive Maintenance Plan can make life easier. Use this checklist to create your own!

Factors determining equipment depreciation

Once you identify which assets’ depreciation can be written off, it is time to identify the factors that affect the depreciation of your equipment. Calculating your equipment depreciation values can be a cakewalk if you know and understand the following factors:

- Cost Value: The cost value is the sum-total amount you paid while purchasing the asset. This includes taxes, transportation fees, installation and set-up fees, etc.

- Useful Life (or Equipment Lifetime): This is an estimate of the number of years an asset is considered to be usable before its value has fully depreciated. An underground storage tank might last for 10-20 years, a forklift for 5-7 years, a conveyor belt 3-5 years, etc.

- Salvage Value: Salvage value is the estimated amount you could sell your asset for if you were to sell it at the end of its useful life.

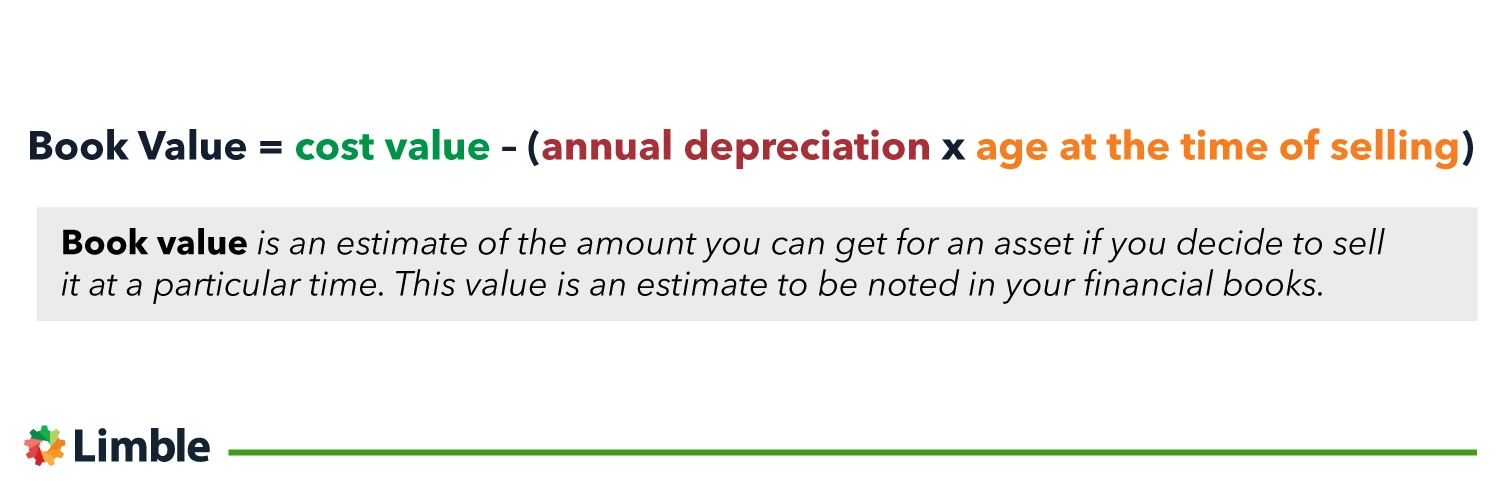

- Book Value: Book value is given by the difference between the cost value of the item and the amount of annual depreciation multiplied by the age of the asset.

Additional note: The exact depreciation rate differs based on the type of asset you are using and the industry you are in. While the IRS does provide broad guidelines, you will probably want to consult an accounting professional to get this right.

What is an equipment depreciation schedule?

A depreciation schedule is a table that is used to chart and track the loss in value of a certain asset over the period of its designated useful life. The point of setting up a depreciation schedule is to stay on top of the depreciation values you’ve already deducted.

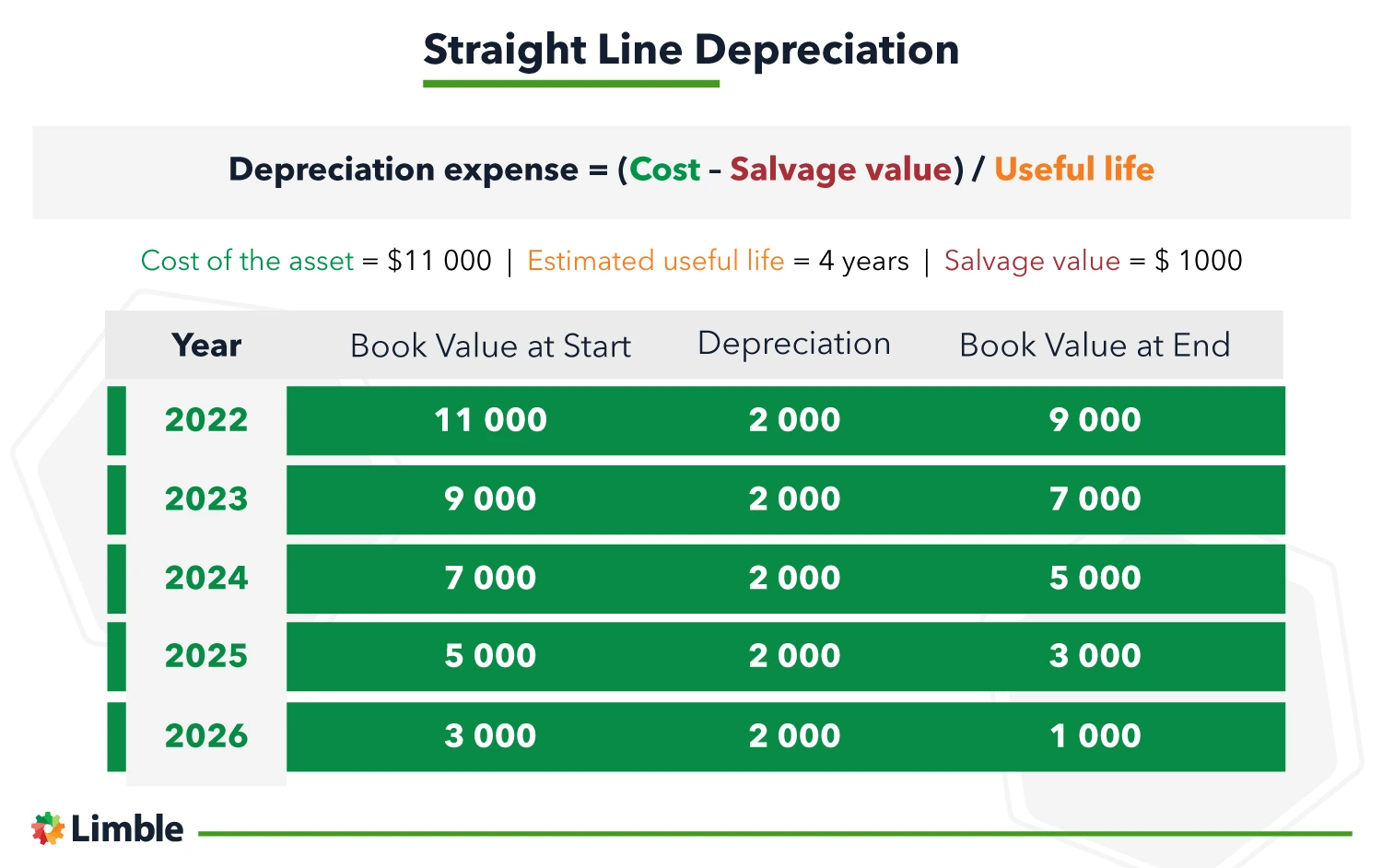

While there are minor differences based on the depreciation methods you are using, a typical depreciation schedule will include similar details:

- Each row represents a year.

- Book Value at Start denotes the book value of the asset at the start of each year before the deductions.

- Depreciation registers the depreciation deduction (aka “depreciation expense”).

- Book Value at End denotes the book value of the asset at the end of the respective year.

You can see all of those fields in action in the examples below.

Common equipment depreciation methods

It’s time to put those equipment depreciation schedules to work. While we can evaluate equipment depreciation through different methods, we will focus on the three most commonly used ones.

Straight Line Depreciation

Straight Line Depreciation is the simplest method for calculating depreciation expense. Here, the expense amount stays the same every year.

The formula to find depreciation value through the straight-line method is:

Depreciation expense = (Cost – Salvage value) / Useful life

For example, let’s say you buy a piece of equipment for $11 000 which has a useful life of 4 years. If its salvage value is $1000, the depreciation expense will be $2000 per year (based on the formula shown above).

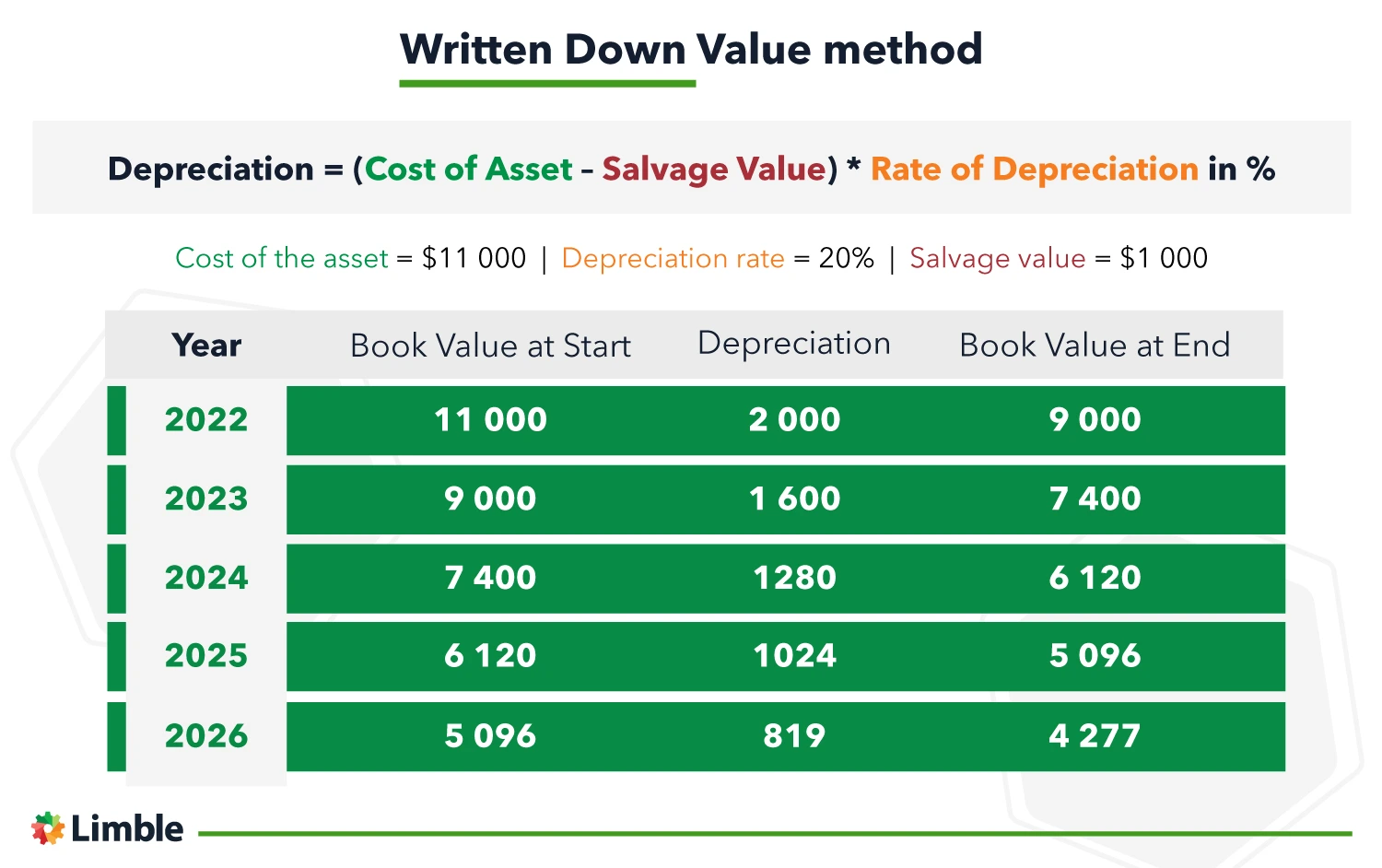

Written Down Value method

The Written Down Value method is an accelerated depreciation method. Simplified, it allows you to start with higher depreciation expenses in the early years and lower in the later years of the life of the asset.

This method reflects the fact that most assets are much more productive in their early years compared to their later years. In other words, this implies the practical fact that assets lose more of their value in the first few years of use.

The formula to find depreciation value through the Written Down Value method is:

Depreciation = (Cost of Asset – Salvage Value) * Rate of Depreciation in %

Like in the previous example, let’s imagine you buy a piece of equipment for $11,000 which has a depreciation rate of 20%. If its salvage value is $1000, the depreciation expense will be $2000 for the first year (based on the formula shown above).

However, in the second year, the depreciation expense will be $1600 because in 2023 the asset will be worth $9000. And so on for each subsequent year.

Below you can see what the depreciation schedule would look like for the first 5 years.

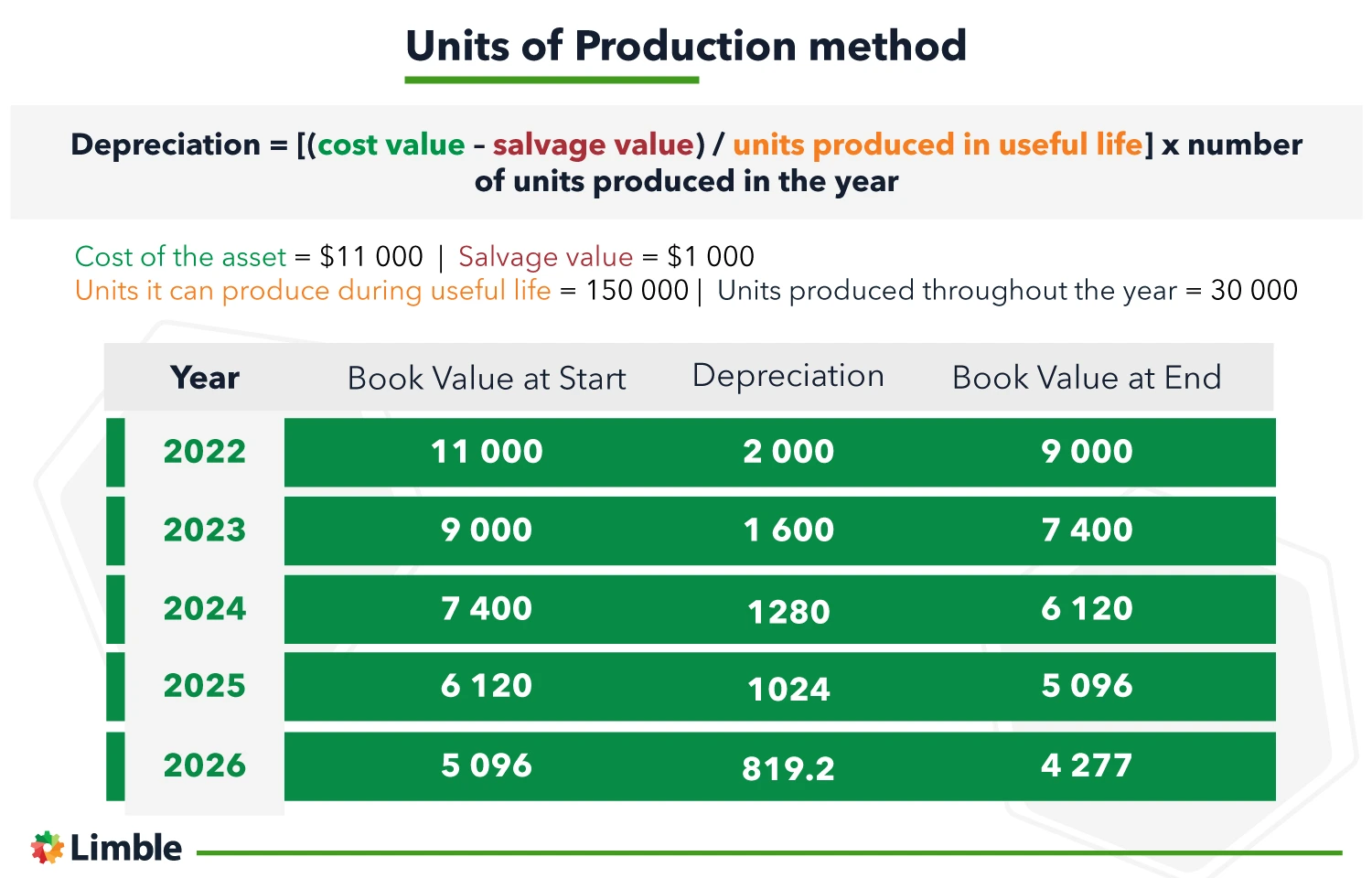

Units of Production method

The Units of Production Depreciation method calculates the amount of depreciation based on asset productivity. While you can use this method for internal bookkeeping, it isn’t suitable for taxes.

The formula to find depreciation value through the Units of Production Depreciation method is:

Depreciation = [(cost value – salvage value) / units produced in useful life] x number of units produced in the year

Consider the cost of the asset being $11,000, with an estimated total unit production of 150,000 throughout its useful life and a $1,000 salvage value. If the asset produced 30,000 units in its first year of working, the depreciation expense for that year is evaluated as follows:

Depreciation expense = [(11,000 – 1,000)/150,000] x 30,000

This gives us the value of year depreciation for the first year as $2000.

The depreciated value becomes the “Book Value at Start” for the next year – and the process repeats (in this case, we estimated that the asset will produce 30,000 units every year).

This method is particularly useful for businesses who want to track the depreciation of their asset at a certain value of units produced.

There are other depreciation methods out there

Some other notable methods for depreciating fixed assets include:

- Sum of Years’ Digits method

- Sinking Fund method

- Annuity method

- Insurance Policy method

- Discounted Cash Flow method

The differences between all of these methods come down to their use of factors that determine the depreciation, and the relevance the methods hold in accounting circles. Regardless, all of them serve the same purpose and are reliable for bookkeeping.

The Essential Guide to CMMS

Download this helpful guide to everything a CMMS has to offer.

The intersection between depreciation and asset management

As we already mentioned, ED plays a supporting role in Asset Lifecycle Management. Asset nearing the end of its useful life can no longer provide a depreciation write-off. You may be better off replacing the machine to start a new depreciation cycle rather than investing in the older model.

But that is just one part of the story. The other part is the need to keep your maintenance and finance teams on the same page.

Minor repairs can be deducted right away, while major repairs and upgrades of fixed assets will be depreciated over time. Both teams, at any time, should have access to the information on when such actions were performed and what was the incurred cost.

Having one value in an Excel spreadsheet, another value in your EAM software, and a third value in your bookkeeping software can quickly create a mess and lead to decisions based on incorrect and outdated information.

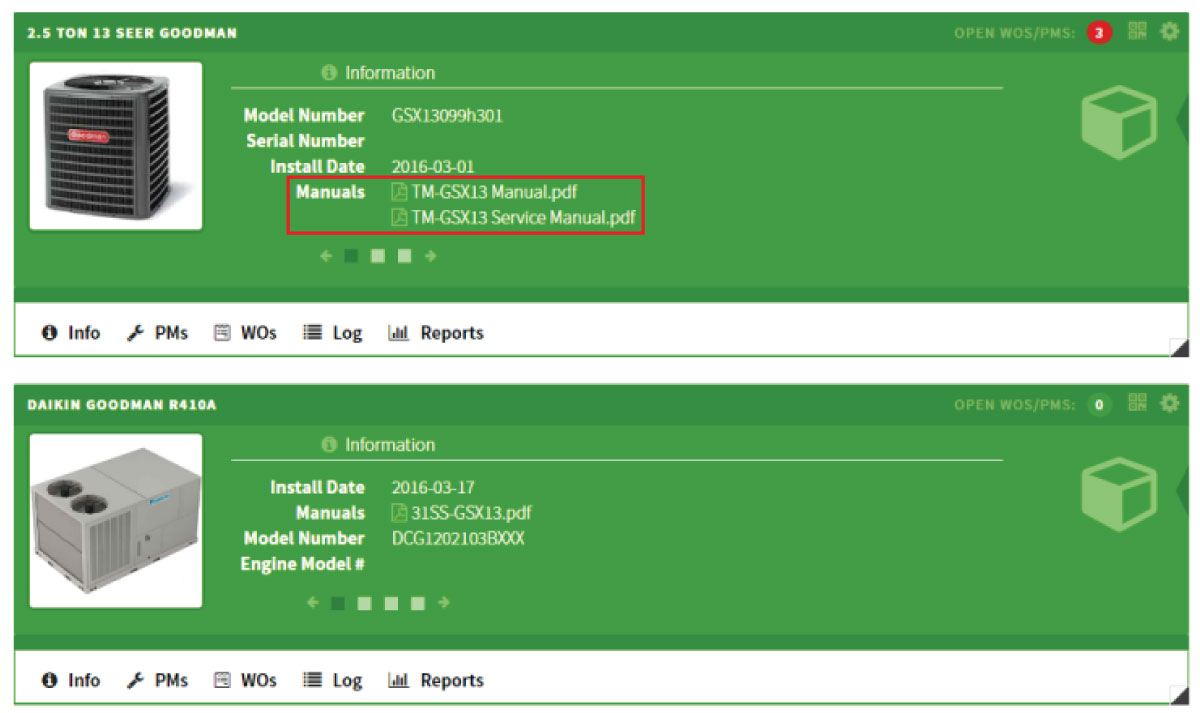

There is a better way. You can use CMMS software to eliminate data silos and have all the required information in one place.

For example, with Limble CMMS you can track all of the basic information about your assets (model and serial numbers, vendor info, manuals, maintenance logs, QR codes for asset tracking and quick identification, etc.).

Asset card inside Limble CMMS

However, on top of that, Limble allows you to define any custom variables you want to track for each asset. To help calculate equipment depreciation, you could add custom variables like:

- Purchase price

- Salvage price (a.k.a. residual value)

- Estimated useful life

- Installation date

- Placed-in-service date (when you started using the asset for the first time)

It is the simplest way to ensure everyone has quick and easy access to the exact same data, which is also accurate and up to date.

Want to see Limble in action? Get started for free today!

Stay one step ahead with CMMS software

The parameters necessary for evaluating your depreciation values often need to be accessed across multiple teams for bookkeeping and taxes. Using Limble CMMS as a centralized location for all of your asset information will make retrieving such data a breeze.

Learn more by scheduling a walkthrough or get in touch with our team to see how Limble can help in your specific use case.