All physical assets are subject to aging and deterioration. Buildings decay and crumble, while machinery loses its functionality through wear and tear. To minimize the fallout from major breakdowns and postpone expensive asset replacements, it is only natural that businesses want to know how to calculate and extend the useful life of assets they own.

The idiom “a stitch in time saves nine” is invaluable in this context. While decay is inevitable, you can still do a lot to delay it. Along with considerable cost savings, it will also give you critical insights for better financial planning. To make it all happen, you first need to understand the concept of the useful life of an asset.

This article explains the relationship between useful life and depreciation, how to determine the expected useful life, and how to extend the life of critical assets.

Understanding the useful life of an asset

The useful life of an asset is a concept in business related to tangible assets. A tangible asset is any asset owned by the business that has a physical form. It could be land, buildings, machinery, furniture, vehicles, tools, or manufactured products (inventory).

The useful life of an asset is the estimated duration to which you can reasonably expect an asset will remain functional and generate income, or provide other benefits. Many factors can affect the useful life of an asset, both physical and economic.

Certain classes of assets, like machinery, come with an expiration date. This gives you a general idea of when the useful life might end. Factors that can shorten an asset’s useful life include improper use/overuse, accidents, floods, the evolution of new technology that makes the asset obsolete, etc.

Conversely, there are measures like preventive maintenance that businesses can take to prolong the useful life of important assets. More on that towards the end of the article.

Useful life and depreciation

The useful life of assets is an important variable in business accounting, closely linked to the concept of “depreciation” – the decline in the monetary value of an asset. When the useful life of an asset ends, it also becomes fully depreciated.

In accounting, depreciation is a valuable tool used to spread the initial cost of asset acquisition across the duration of its use. It has major tax implications and can also impact your balance sheet (as an expense).

Checklist for Creating a Preventive Maintenance Plan

Following a consistent Preventive Maintenance Plan can make life easier. Use this checklist to create your own!

The importance of useful life estimates

Useful life estimates have long-term implications on several different aspects of your business:

- Accounting: depreciation rates have a significant impact on your balance sheets, income statements, tax liability, and cash flow (indirectly). To calculate depreciation, you need to know the useful life of an asset.

- Financial planning: useful life and depreciation tell you how long you have before significant investment is required for the replacement of critical assets. This will have a fundamental impact on your medium and long-term financial planning and budgeting.

- Maintenance and safety: to ensure maximum workplace safety, you need to conduct routine maintenance of equipment and facilities. Failure to do so will increase the risk of catastrophic equipment failures and accidents. Keeping tabs on the useful life estimates of assets will help in the development of adequate preventive maintenance schedules.

- Asset salvage value: you can often recoup at least a portion of your initial investment in an asset by selling it at the end of its service life. This salvage value is another key component of depreciation calculations. For accurate estimation of asset salvage value, you need to be aware of that asset’s useful life.

The end of useful life does not necessarily mean the end of life for an asset. Rather, it is like retirement. The assets at the end of their service life may still hold value for others outside the business. Many businesses routinely salvage aging machinery and vehicles, through auctions and other means. This helps reduce or prevent financial loss on the books by returning a salvage value to the business through resale.

How to determine the useful life of an asset

The useful life of an asset is an estimate, not an exact number. All tangible assets are assumed to have, at the bare minimum, one year’s worth of useful life. While there is no need for extreme precision down to weeks or months, one should always be cautious when making useful life estimates.

Even a magnitude change of just a couple of years in the useful life estimate of a capital asset will show as a significant change in the account books in the form of depreciation. So, it is always advisable to exercise due diligence when determining the useful life of asset.

Factors that impact asset useful life

Various internal and external factors can affect the service life of an asset. While some of these will be physical factors, others could be financial or even technological in nature.

Here is a list of important factors that are should be taken into consideration while assessing the (remaining) useful life of an asset:

- Asset condition at the time of purchase: a new asset will obviously last longer than a previously used one.

- Usage patterns: assets that undergo heavy usage are more likely to face increased wear and tear. Likewise, some equipment/buildings that stay unused for extended periods may also see a decrease in service life.

- Climate/geography: assets located in areas with extreme climates, or prone to natural disasters (fire, flood, etc.) might need lower useful life estimates.

- Technology: technological advancements can lead to faster obsolescence of certain assets. Computers and other digital devices are a good example of assets that get outdated relatively fast.

- Government/compliance: especially with the ongoing climate crisis this aspect has assumed greater significance. Equipment and vehicles that do not pass newer environmental norms will have their service life reduced.

Incidents and major breakdowns can reduce asset lifespan. Maintenance professionals should keep an eye on asset condition and warn about potential needs to adjust asset useful life estimations.

Estimates of the useful life of fixed assets

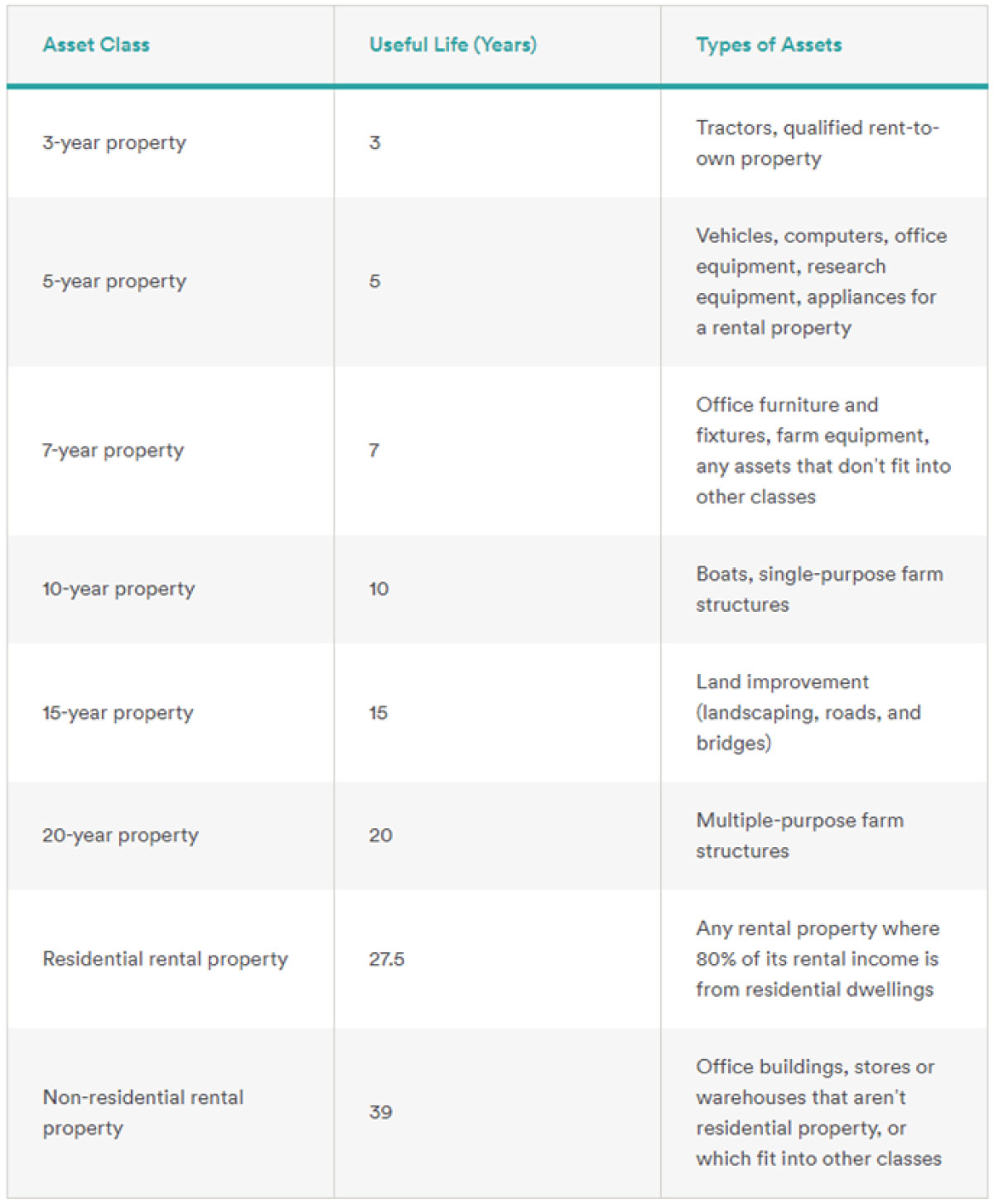

From an accounting perspective, the main authority on useful life estimates of business assets is the government tax agency. For example, in the United States, the Internal Revenue Service (IRS) has set depreciation standards for most classes of tangible assets.

Here are some highlights from a very long list of assets:

Depending on the types of assets, you may also use guidelines from widely respected industry bodies. For example, you can use the Building Owners and Managers Association (BOMA) for office real estate or the Gordian RSMeans database for construction-related assets. From that baseline, you are free to make judicious adjustments based on factors that are relevant to your case.

How to calculate useful life of asset

There are two main approaches to calculating depreciation: straight-line depreciation and accelerated depreciation.

Before you pick up the calculator, you need to know the following inputs:

- Cost of the asset: cost of an asset includes the total costs of acquisition – purchase cost, transportation charges, installation charges, cost of training personnel, etc.

- The useful life of the asset: estimated using the resources mentioned earlier and/or based on the information available in the OEM (original equipment manufacturer) manual.

- Salvage value: the resale value of the asset at the end of its useful life, often available in guidelines from reputed industry organizations.

Straight-line depreciation

The straight-line depreciation method results in annual depreciation deducted in equal installments throughout the asset’s service life. The result is a steady decline in the value as you write off the same amount every year.

Straight-line depreciation is the easiest and simplest method for calculating the depreciation of assets. As a result, it is also less prone to errors, making it the preferred model in most circumstances. It is ideal for fixed assets whose value is expected to experience a steady drop over the years.

Straight-line depreciation example: Commercial building

Consider a new warehouse building worth $1,000,000 with a standard useful life of 30 years. The estimated value of the land is $200,000. Subtracting the land value from the asset cost, you get $800,000. Divide that by the useful life to get $26,666. This is the annual depreciation value for the warehouse over those 30 years.

Here is some further reading if you want to learn more about this model.

Accelerated depreciation

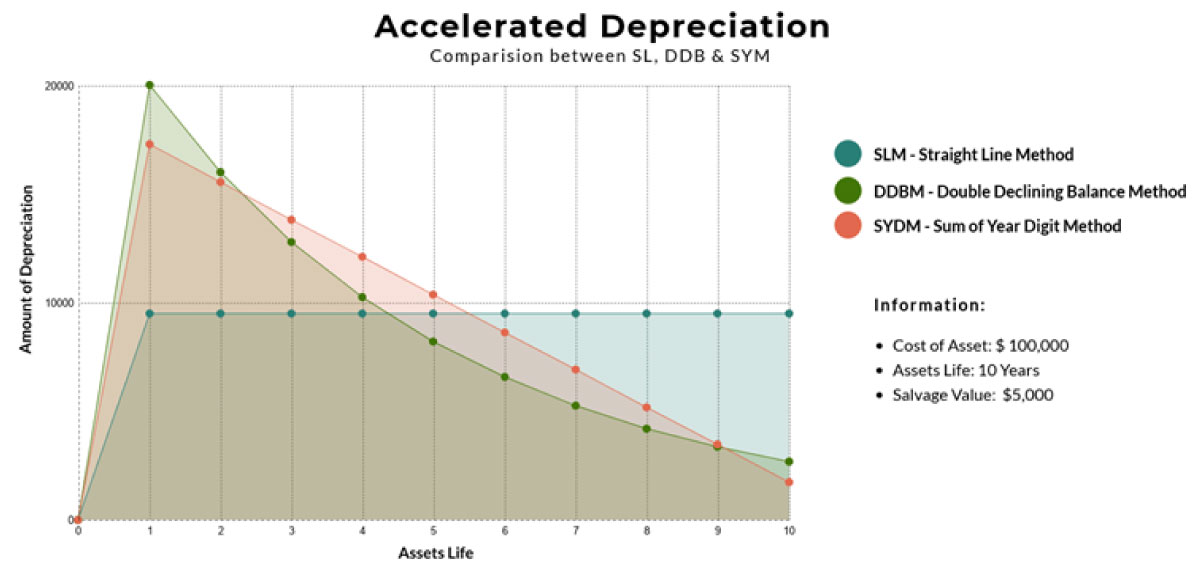

There are several different methods under the category of accelerated depreciation (you can see two in the image above – DDBM and SYDM). Despite the complexity of these methods, there are reasons for using the accelerated model:

- It is the most appropriate approach for assets like computers which get obsolete faster than other assets. The sharp fall in the value of the asset in the initial years replicates that trend.

- It reflects the common usage pattern where a newly acquired asset is used heavily in the early years, resulting in more wear and tear.

- Businesses may opt for accelerated depreciation for specific tax strategy reasons.

Accelerated depreciation example: CNC machine

Let’s say a business buys a CNC machine with a total cost of $200,000. For a production-grade 3 axis mill, we can set the useful life at a reasonable 10 years.

Due to heavy use in its initial years, the firm wants to use accelerated depreciation for this asset. They estimate the salvage value at $20,000. Using the straight-line method, we get an annual depreciation of $18,000, so around 9%. By increasing that by 150%, we get a depreciation rate of 13.5%

In the first year, the value of the CNC machine would depreciate by $27,000. In the second year, the depreciation will be 13.5% of the current book value of $173,000, which turns out into $23,350. Using the formula, here is a quick chart of depreciation for the following years:

- Year 1: $27,000

- Year 2: $23,350

- Year 3: $20,190

- …

- Year 10: $7317

At the end of year 10, accelerated depreciation will leave the value of the CNC machine at $46,935. The difference between this and the salvage value – $26,935 – is usually credited as an expense in the accounting books.

You can find more info about accelerated depreciation in this guide.

5 practices for extending the useful life of critical assets

Useful life estimates and guidelines are not set in stone. Businesses can use some forward-looking measures to extend the effective life of their assets and save money in the long run.

Best practices for extending equipment lifespan include:

- Proactive maintenance: proactive asset management strategies like preventive and predictive maintenance are essential to keep breakdowns at bay. This is important as major breakdowns reduce asset lifespan. Use CMMS to schedule proactive maintenance tasks and ensure they are performed on time.

- Machine operator training: invest in appropriate operator training modules when dealing with heavy machinery or other specialized equipment. Set up an onboarding process for new operators to get them familiar with all assets they will be in contact with.

- Following OEM guidelines: diligently follow the user manual or vendor guidelines when putting assets to work and make suitable adjustments based on the workplace environment.

- Buying the right asset in the first place: perform due diligence during the asset procurement process to ensure that the acquired asset perfectly fits your use-case scenarios.

- Using original spare parts: source replacement parts and tools from the vendor, or authorized dealers to ensure that there is no compromise on the quality of those components.

Keep in mind that the life of some assets cannot be extended. For instance, fire extinguishers, smoke detectors, and similar safety devices must be replaced after a certain number of years. That is required by law, regardless of the actual condition of the asset.

In these circumstances, proactive maintenance and other methods are still necessary to ensure assets reach their expected life and do not have to be replaced prematurely.

Take care of assets so they can take care of you

The business can’t function properly if important assets are in poor condition. Investing in proactive measures not only increases asset useful life and reduces costs, but also improves safety, productivity, and employee satisfaction.

Any business that seeks to be productively efficient can’t keep maintenance on the sidelines.