No matter the industry, an organization must have a clear picture of its physical assets. Asset audits help you keep a close eye on your most valuable equipment, and prevent it from becoming a liability.

This article will outline how to set up an efficient asset audit process and explain why you should invest time in doing such a seemingly exhausting task on a regular basis.

What is an asset audit?

An asset audit is a process of reviewing all of your assets to verify their status, providing an accurate picture of what you actually own. It is done to ensure facility asset management is done transparently, accurately, and responsibly.

To do so, organizations must:

- Determine whether or not an asset shown in the balance sheet physically exists

- Assess the physical deterioration of assets and the asset value

- Identify risks to the asset’s proper functioning

- Ensure the asset meets applicable requirements and regulations

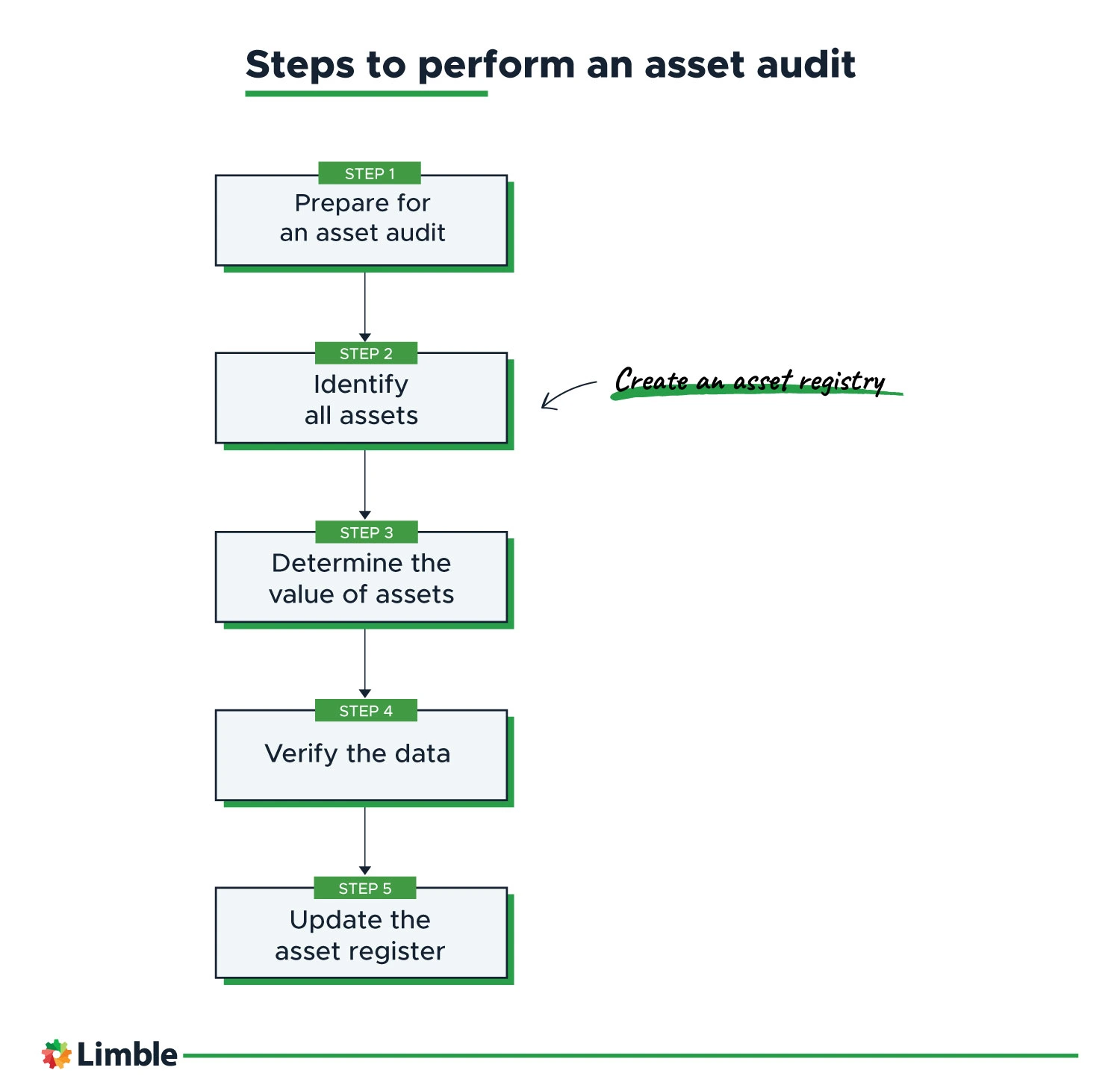

How to perform an asset audit

Asset audit procedures vary from one organization to another. The auditors themselves usually decide how it gets done, but there are typically a few common steps in every audit.

1. Prepare your organization for an asset audit

To prevent a sloppy internal audit, plan ahead. Here are some essential preparation steps:

- Set dates for auditing

- Form teams and assign responsibilities

- Identify data sources and write audit checklists

- Check for any new regulations that may impact your assets

- Allocate the appropriate resources for auditing (personnel, time, access to required records)

- Decide which tool you will use to record and report the process

As you can see, having diligent accounting and maintenance teams that keep asset records up to date will pay off quickly in this step.

2. Make a list of your physical assets

If your organization already hasan accurate asset registry, the audit process will be noticeably smoother. Auditors will need to manually compare assets to their records later (in step 4) to confirm the asset’s condition and the accuracy of the record.

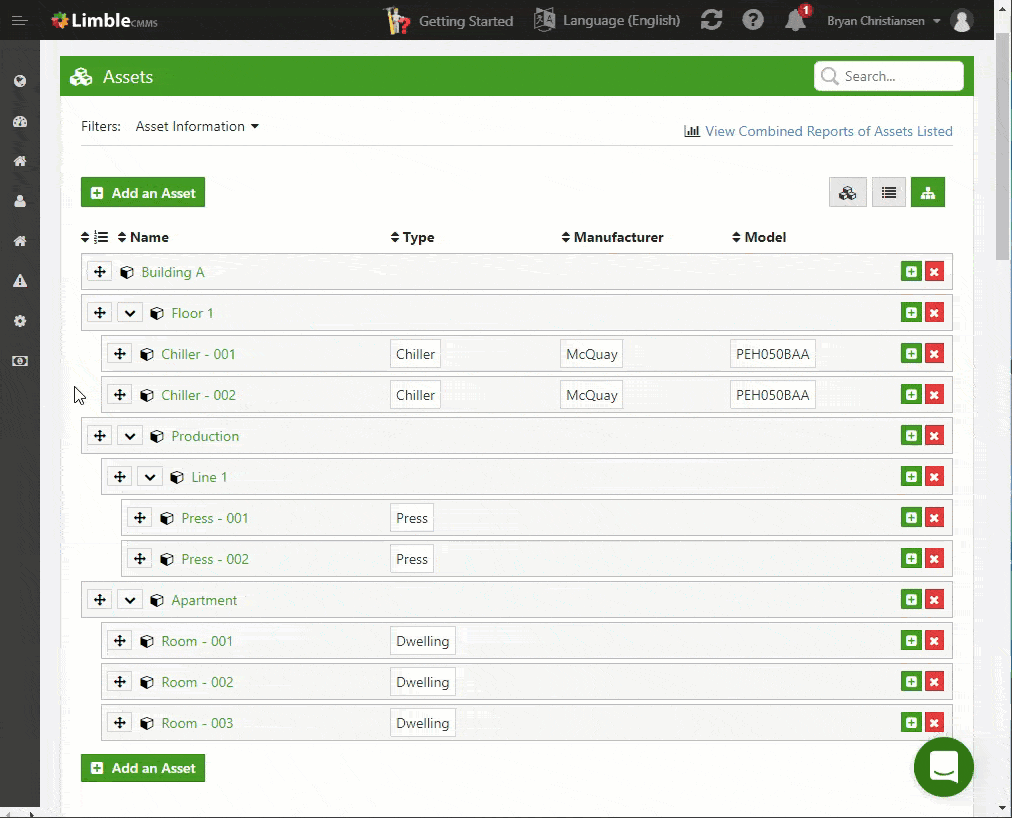

Below is how an asset register looks within Limble CMMS.

An example of hierarchical asset structure inside Limble CMMS

When creating a list of assets from scratch, use a hierarchy based on the asset’s role, priority, or location (as shown in the image above).

Fields you should record while creating the list include:

- Location: It is unlikely all your assets are in the same department or on the same floor. Write down the specific location of each asset in your asset record.

- Manufacturer, model, and serial number: This helps identify and differentiate between assets of the same type.

- Purchase/installation date: This information helps in planning for asset depreciation, replacement, or even setting a maintenance schedule.

- Specific asset data: Track other specific details that you might need to properly maintain the asset or satisfy external auditors (such as preventive maintenance history).

CMMS users will likely already have this data since most systems require it when adding a new asset to the asset register.

3. Determine the value of your fixed assets

The value of your company assets changes over time — sometimes substantially. It is essential to determine the current value of your assets as part of your audit. This will also help you perform asset lifecycle management, and determine how much your business is worth.

The methodology used to calculate the value of assets depends on the asset you are verifying. Have your accounting department help you with asset valuation. You will most likely use the three principal methods to determine the value of your “tangible” assets:

- Cost method: The value of the asset is its purchase price.

- Market value method: The market price of your asset is its present value.

- Value-based method: The value is derived after subtracting the accumulated depreciation from the asset’s original cost.

4. Verify the accuracy of the data

Use the asset register to physically verify each asset on your list. Make sure they exist, and confirm their condition — whether or not the asset is working — and compliance with the latest regulatory standards.

Verification helps you substantiate the data in your balance sheet and ensure that the asset data you have on file for reporting and planning is accurate.

If there are any discrepancies, make a note of them for the next step.

5. Update the asset register

After you’re done auditing, make sure to compare your findings with the list of assets you created in step 2 or pulled from your asset management system (if you’re using one). Take the following steps to update your asset register:

- Tag each missing asset as a ghost asset to be written off.

- Correct discrepancies in your asset register to ensure it is complete and up-to-date.

- Identify patterns or root causes of discrepancies in your asset register or other documentation.

This last step is critical: it is often overlooked but is the most valuable. Keeping an accurate asset register can be a challenging task, especially for assets that are often moved across multiple locations. Following up your audit by improving your documentation practices will prevent data and compliance issues later.

Make sure to leverage internal controls like the following:

- Create SOPs to be followed when moving assets to a different location or returning an item to inventory.

- Create a naming convention to make sure everyone is entering asset data in the same format.

- Create a labeling system to tag or barcode assets in order to simplify asset tracking and ensure more accurate records.

- Use a CMMS or other software to digitally track your fixed assets.

Objectives of an asset audit

The accuracy of your balance sheet and financial records is important. Asset audits prevent misstatements and can ensure decisions are made on firm ground.

If you still need convincing, here are additional benefits of running regular asset audits:

- Planning for capital upgrades: The audit enables planning for future system upgrades, equipment replacements, or other capital expenses.

- Depreciation Management: The value of your assets decreases over time due to wear and tear. Regular asset auditing offers a way to track the depreciation of every asset.

- Regulatory compliance: All companies must adhere to government and industry regulations; failing to do so can result in hefty fines. The asset audit identifies equipment and uses that fail to meet ever-changing guidelines — so you can quickly fix a compliance violation.

- Managing expenses: Frequent asset audits help optimize asset use and set maintenance schedules, which reduce damage to machinery and equipment. They also ensure there is no loss or theft of assets.

- Eliminating ghost assets: There are assets that you cannot physically verify because they are either stolen, lost, misplaced, or destroyed — but they still appear on your balance sheet and financial reports. The audit enables you to identify such assets and remove them from your asset record.

Use a CMMS to simplify asset auditing

Manual auditing is a thing of the past. Digitalization of the fixed asset audit process improves its speed and accuracy by a large margin.

There are a few different tools that will provide quick access to real-time data about all assets in your organization — CMMS software is one of them.

When used properly, it will:

- Accurately track the location of all your assets

- Eliminate virtually all paperwork

- Provide an asset registry where you can store asset information — location, associated cost, manufacturer, model, serial number, performance, downtime statistics, etc.

- Allow you to quickly extract relevant and accurate data for asset auditors

- Help you generate real-time reports

- Help ensure your assets are regularly maintained and meet regulatory requirements

If you’re still not convinced, check how Limble CMMS helped Spectrum Solutions aced their external audit.

Asset auditing is essential — don’t neglect it

The performance and reputation of your business often hinges on your assets. They facilitate business operations and increase the value of your company.

Frequent audits are recommended for equipment with high mobility such as vehicles, while annual audits will be sufficient for static equipment like machinery.

The best way to simplify an asset audit — and asset management in general — is to implement a modern asset management software or CMMS like Limble.

To see Limble in action, schedule a product demo or start a free trial.