You cannot create anything of value without owning assets. Every organization needs some machinery, tools, vehicles, or IT equipment to conduct its business. However, the power assets provide comes at a cost.

Financial management, health and safety regulations, accounting, and tax compliance are some of the many reasons you should keep a close eye on the current status of your high-value assets. To accomplish this, you need to have an up-to-date asset register.

In this post, we discuss everything you need to know to create and maintain a highly accurate asset register.

What is an asset register?

In schools and offices, you have attendance registers that keep track of the people who are present on-premises on specific days. Public sites like museums or hotels use visitor registers or log books to do the same.

An asset register has a very similar function — keeping track of all the vital assets owned by a business. It is basically a list of assets that includes asset names, descriptions, locations, purchase cost, currently estimated value, and a bunch of other fields we will discuss later in the article.

The benefits of having highly accurate asset data

Businesses, especially those in the industrial sector, have to allocate a decent chunk of their capital each year to asset acquisition, maintenance, and repairs.

Given the significant financial implications, keeping a close eye on your assets pays out in more ways than one:

- Accounting: With so much money riding on assets, businesses must keep close tabs on their age and current value. Depreciation is a vital tool that allows you to recover a part of the total acquisition cost of the asset over its lifetime. It also has implications for your bottom line.

- Maintenance: Physical assets degrade over time with constant use. Proper maintenance scheduling is essential to prevent catastrophic breakdowns and prolong the operating life of the asset. An accurate asset register will help you plan and execute the maintenance work required.

- Theft/fraud prevention: The absence of asset tracking can lead to theft or mismanagement of valuable assets. An updated asset register acts as a deterrent and an early detection tool for any kind of shady activity.

- Compliance: Heavy machinery and vehicles often have strict oversight and maintenance regulations. Asset registers help your organization stay compliant as they provide evidence that you are following recommended practices.

- Revenue generation: Full visibility enables you to deploy your business assets more efficiently, avoid under-utilization, and plan fail-safes and redundancies. This can boost revenues by reducing waste and repair costs, as well as by improving overall productivity.

Who creates and maintains the company’s asset registers?

In smaller businesses, the owner or proprietor is the one who prepares and maintains the asset register. In more complex organizations, the responsibility falls to either the financial/accounting manager or the director. They will usually delegate this task to their subordinates.

Depending on the asset being tracked, the actual duty of keeping the data updated will be in the hands of a designated individual or team. For instance, a maintenance supervisor is often the person responsible for keeping the maintenance data in the register up to date for all assets under their direct supervision.

Free Essential Guide to CMMS

Discover everything you need to know about CMMS in this comprehensive guide. Begin your maintenance journey now!

There are two main types of asset registers

Assets can be divided into different categories like fixed assets, current assets, tangible and intangible assets, etc. Similarly, asset registers also come in different flavors, depending on factors like the size of the business or the type of asset that is being tracked.

Small businesses with fewer assets will have one master register for all assets. Large corporations, on the other hand, will have more sophisticated and diversified registers.

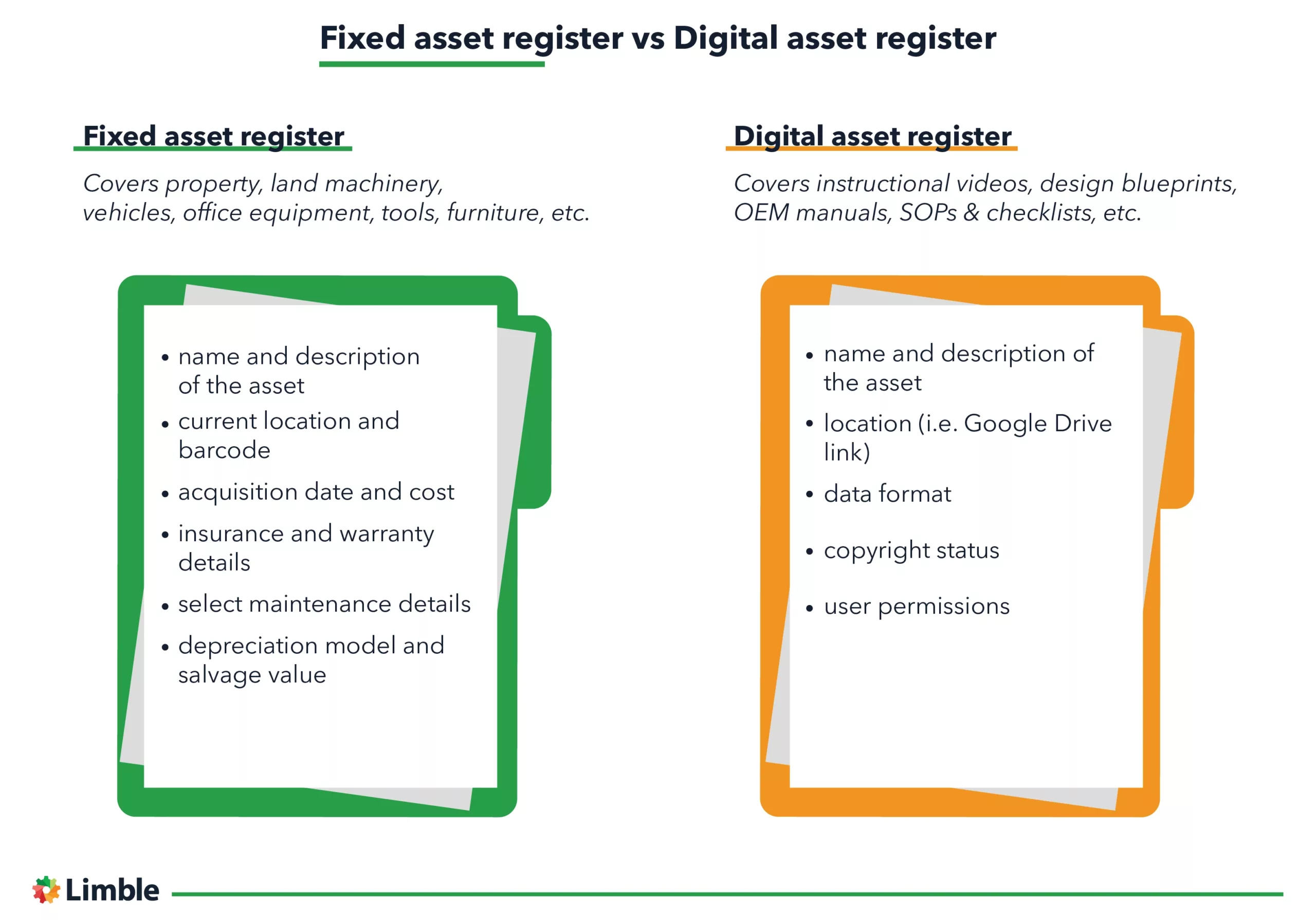

The most common classification is based on the type of assets that you track — fixed or digital.

Fixed asset registers

Land, property, machinery, vehicles, office equipment, tools, and furniture are just some examples of fixed assets. The asset information from these tangibles is recorded in a fixed asset register, the most common type of asset register out there.

Many businesses have invested heavily in IT and networking equipment in recent years. Such organizations may benefit from having a separate IT asset register. In firms where IT occupies a more peripheral role, computers and other networking equipment are simply added to the fixed asset register.

Digital asset registers

Nobody is safe from the steady march of digital transformation — not even industrial businesses. The demand for digital assets like instructional videos, design blueprints, maintenance logs, OEM manuals, and software has increased dramatically since COVID.

As their name suggests, digital asset registers keep track of a firm’s digital asset portfolio. Both fixed and digital registers track basics like the name, description, serial numbers, and location of the asset. However, there are some exceptions, and we will highlight those in the next section.

Things to include in your fixed asset register

An asset register is a very versatile document database used to store a diverse array of data points. Here is a quick overview of commonly stored variables:

- Name and description of the asset: Businesses often use codenames instead of full names of the assets. Accompanying that with a short asset description makes it easier to identify and update correct fields.

- Acquisition date: This is either the date of purchase or the date of its creation (in case the asset was built/assembled/constructed in-house).

- Acquisition cost: Describes how much money you spent to acquire the asset, or build it using various inputs and raw materials.

- Current location: Immobile assets like furniture, desktop computers, or a CNC machine are easy to track as they rarely change location. For highly mobile equipment like vehicles and tools, you will want to apply some version of asset tracking to keep this variable up-to-date.

- Ownership status: Holds the name of the individual or entity under which the asset was purchased. If the asset is leased, that should also be mentioned here, along with the original owner.

- Authorized users: A list of individuals with formal access to a specific asset, and those responsible for its management.

- Barcode: If your business uses any scanner technology for asset tracking, the relevant barcode linked to the asset should be displayed in the register.

- Insurance: Includes details on the asset’s insurance coverage, including the type of risks covered and policy duration.

- Warranty: Specifies the duration of the equipment manufacturer (OEM) warranty, with any additional information on return or exchange eligibility.

- Maintenance: This can include many things, from the current maintenance schedule to the history of major repairs, and the details of technicians who conducted said activities on the asset.

- Current value: Specifies the estimated value of the asset in its current condition.

- Depreciation: Specifies the equipment depreciation model used in accounting for the company’s losses on the asset over the years of operation.

- Salvage Date/Value: The expected year in which the asset’s operating life will end. You may also mention the expected resale/salvage value of the asset at that date.

You can include most of these data points in your digital asset registers as well. The exceptions are warranties and maintenance-related info as those are not relevant for digital items. Instead, you can include details such as copyright status, data format, and any risk factors that may affect the value of the asset.

Of course, the final list of included variables will depend on your internal needs, as well as the regulatory requirements you need to satisfy.

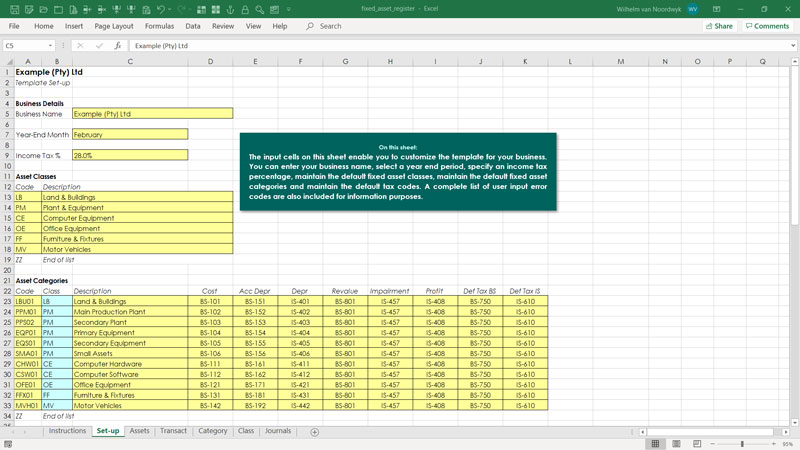

A couple of quick examples of fixed asset registers

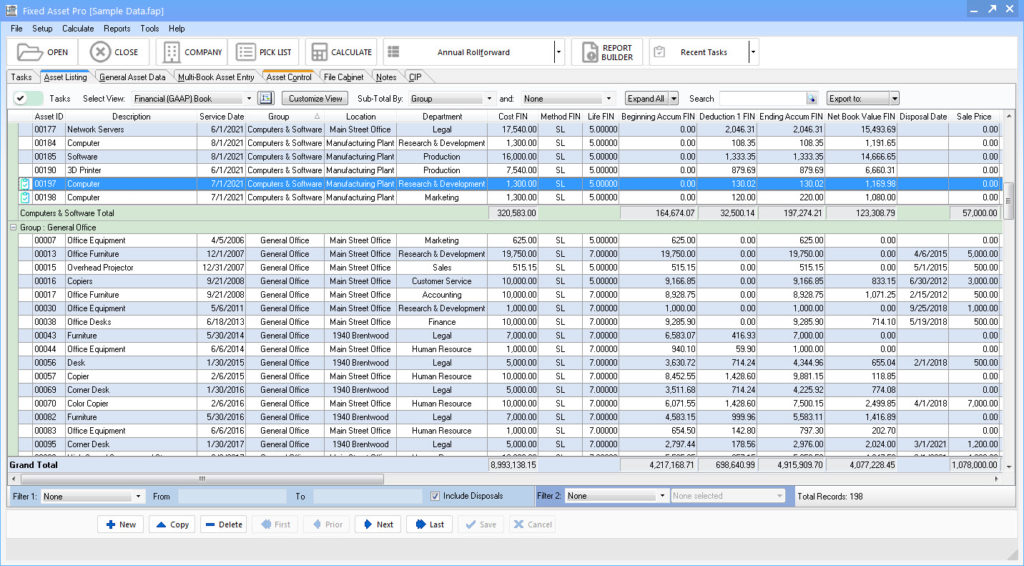

If you have never seen a fixed asset register, here are two quick examples. The first one features an Excel spreadsheet, while the second one is built using dedicated fixed asset management software, which also assists with different depreciation methods.

An example of a fixed asset register template in Excel. Source: Excel Skills

An example of a fixed asset register from specialized software. Source: MoneySoft

How to create an asset register

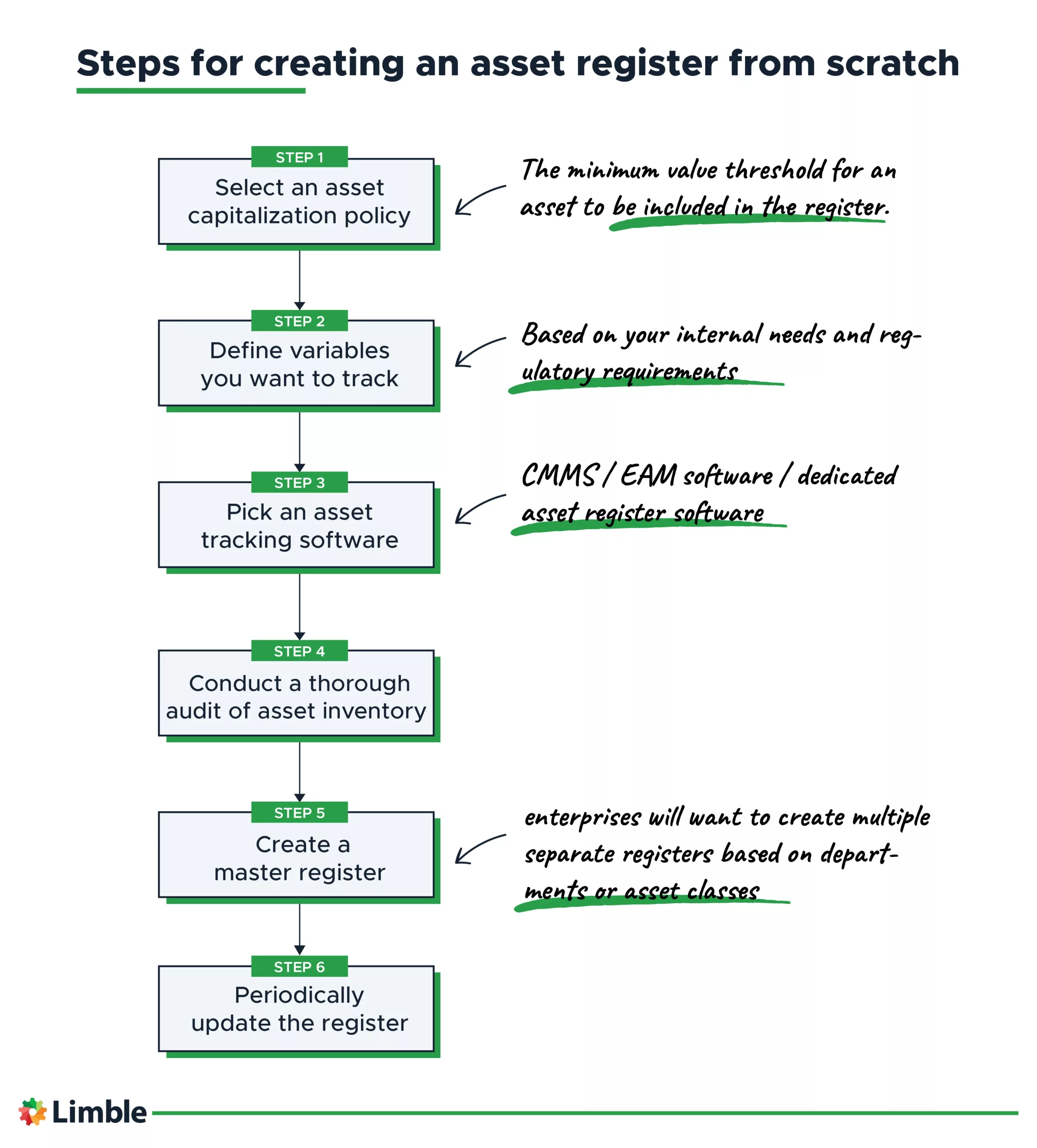

While creating an asset register from scratch can be tedious, it is a fairly straightforward process.

Below are the steps you need to take, along with some important considerations you’ll need to pay attention to.

1) Select an asset capitalization policy

When creating an asset register, the first question you will need to address is: what is the minimum value threshold for an asset to be included in the register?

Small businesses will keep it as low as $500 — meaning that all assets with a purchase cost above that number will need to be added to their asset register.

Enterprise-level organizations that rely on more expensive equipment will often keep the capitalization policy much higher, at $5000 or more.

2) Assess the regulatory/compliance requirements and finalize the variables you want to track

Asset tracking has major implications for your accounting and auditing processes. Depending on the type of equipment used and the industry you operate in, you will have different compliance and reporting responsibilities. For example, vehicles and heavy equipment require strict maintenance and testing schedules for safety reasons.

These factors will influence the final list of data points you want to include in your asset register.

3) Pick an asset tracking software

Small teams can get by tracking assets with old-fashioned excel spreadsheets. However, past a certain point, this method causes more harm than good. It takes up too much time and effort, with a high risk of errors.

Luckily for you, there are plenty of asset management systems on the market you can use to build and maintain your asset register. Industrial businesses will often do that by employing their CMMS or EAM software.

4) Conduct a thorough audit of your asset inventory

This can be a very time- and resource-intensive process. Nonetheless, this is not the place to make excuses and cut corners. A thorough job here is essential for the long-term accuracy and reliability of your asset-tracking efforts; and audit trail will help cut down time on future efforts.

Conduct a physical examination of your facilities and take stock of the available assets. Do not forget to collect all possible data sets that match your regulatory/compliance requirements reviewed in the second step.

While you are at it, you might as well generate, print, and paste QR codes on your assets to speed up future asset audits. If you are using Limble CMMS software, people can use those barcodes to quickly submit work requests, while technicians can use them to quickly identify an asset and pull its information from the CMMS database.

Here is a 1-minute video that showcases how simple it is to generate and print asset QR codes within Limble.

5) Create a master register

Input and collate the data collected during the audit stage into your chosen software solution. You can now create a master register for all assets that fall under the range of your capitalization policy.

If your business is large and complex, you may want to create separate registers for individual divisions/departments, or various asset classes like real estate, fixed assets, IT/digital assets, etc.

6) Monitor assets and regularly update your register

Your job does not end with the creation of the register. If it’s not up-to-date, the data inside it is worthless — especially for decision making.

For largely immobile fixed assets like plant and machinery, annual audits should work fine. On the other end of the spectrum, for expensive machinery and vehicles with higher mobility/wear & tear you may want to invest in sensors and tracking systems for constant, 24×7 visibility.

Best practices for maintaining asset register accuracy

With everything else a business has to do, keeping track of your assets is rarely a priority. In the absence of appropriate safeguards, it is not unusual to lose track of important assets, let alone keep an asset database up-to-date.

Here are a few best practices to help you maintain a highly accurate asset register.

Create an SOP for registry tracking

Maintaining an asset register is a continuous process, involving many individuals and departments in an organization. Everyone responsible for managing the asset register should follow the same standard operating procedures (SOPs).

Every employee should be aware of the procedures for updating variables like asset location, asset status or maintenance status. Whether they are supposed to update on their own or contact a designated supervisor, all departments across the organization should follow the same steps.

Track only truly relevant data

Data collection and management is a time-consuming process. Just because you can collect dozens of different asset data points and metrics doesn’t mean that you have to include them in your asset register.

Moderation is essential. Track only those data points that make sense from maintenance, accounting, and compliance POV.

Create a hierarchy of assets

Instead of listing all assets haphazardly, try to create a formal hierarchy of assets based on their priority and role in your organization.

Some assets are inactive/peripheral and don’t require constant monitoring. Others, usually the ones with high rates of depreciation and operating costs, should be monitored more closely.

The hierarchy will make it easier for your teams to find and update asset data.

Limble CMMS features a drag-and-drop interface you can use to organize assets in your database. If you run a big facility or manage multiple locations, you will fall in love with this feature.

Establish a labeling convention

When you have a complex hierarchy of assets with various sub-categories, it makes sense to create a special labeling system for your assets. Create an intuitive labeling system involving codes and numbers, and ensure that all relevant personnel understands how to use it.

Use Limble as your asset register software

An asset register is a vital database that fosters sound financial management, helps cut unnecessary expenses, increases the operational life of your assets, and helps you deal with various compliance and tax issues.

There is a deep connection between accurate asset data and efficient maintenance.

The best way to keep track of all of your maintenance and asset data is to implement a digital centralized maintenance platform like Limble CMMS. After all, having a modern CMMS is the first step towards taking control of all aspects of asset management.