Keeping critical assets up and running means investing in a maintenance program that’s supported by savvy professionals and effective technology. The annual costs associated with maintenance management can easily get out of control when organizations don’t take the time to identify the appropriate tools and implement cost effective strategies.

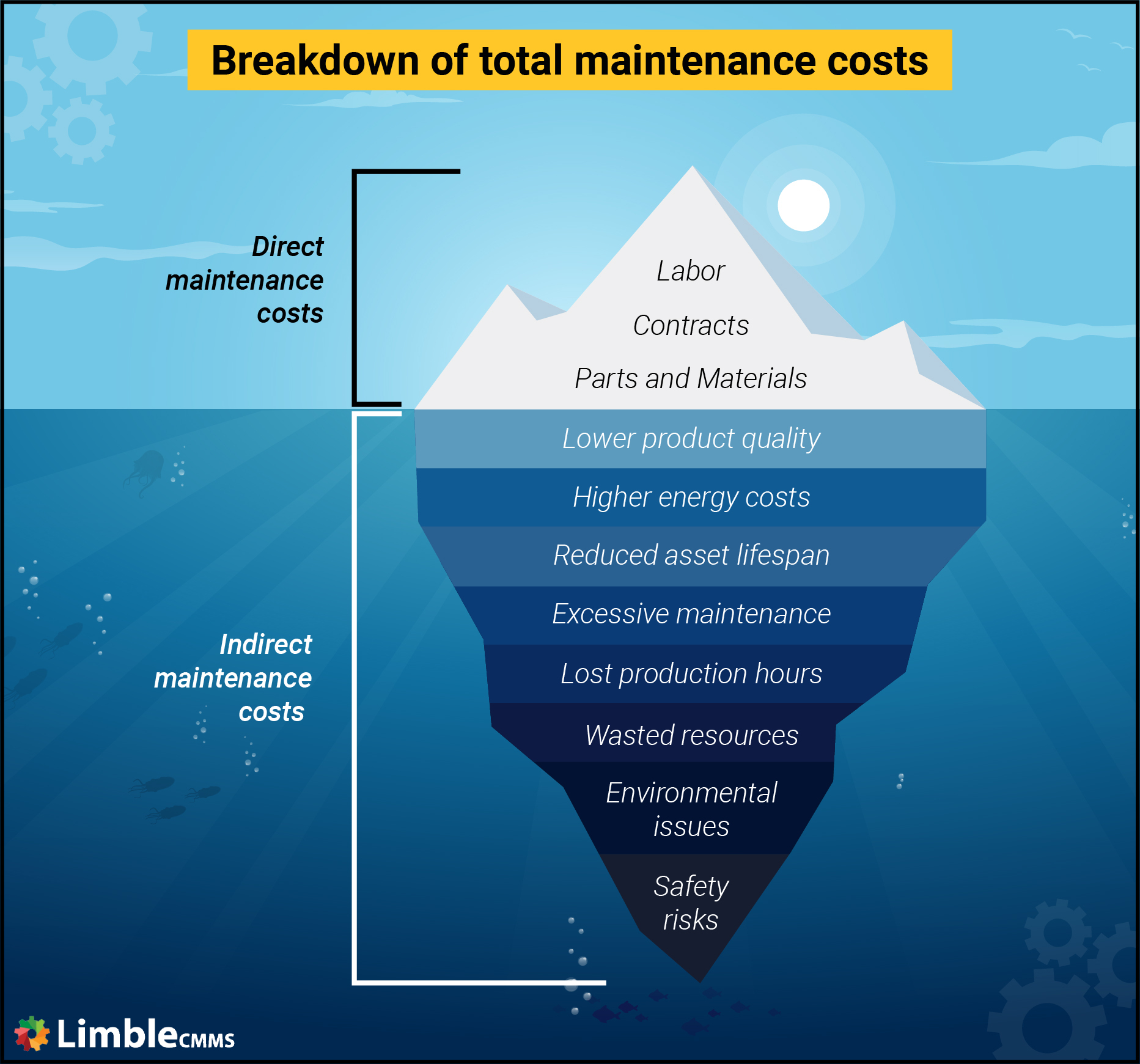

Maintenance costs include all the direct and indirect expenses of upkeep, repairs, replacement, and all maintenance activities. Some costs – like the sticker price for new equipment – are obvious. Others are hidden, often accumulating unnoticed.

Some maintenance expenses include:

- Routine upkeep, major repairs, and other maintenance activities

- Repair or replacement for vehicles

- Real estate costs like rent for storage facilities

- Safety costs

- Subscription fees for maintenance software like CMMS platforms

To keep costs manageable and employ the right types of maintenance strategies, you first need to understand these expenses and where they originate.

Understanding maintenance costs

Your maintenance costs include all the expenses that result from your efforts to keep physical assets in optimal working condition. It doesn’t matter if that asset is a car, a rental property, a generator, or a circular saw – if it needs regular maintenance for managing depreciation or could potentially break down, it will incur maintenance costs.

Manufacturing, aviation, construction, and other asset-heavy industries are compelled to keep their maintenance budgets in check. Tracking maintenance costs is a key method for evaluating the effectiveness of their maintenance departments. The cost and ROI of maintenance activities are metrics for the department, useful for driving ongoing improvements.

The direct and indirect costs of maintenance.

The hidden costs of maintenance

The wrong maintenance strategy will hurt your organization in a number of ways. It will cause lower product quality, higher energy costs, reduced asset lifespan, lost production hours, wasted resources, environmental issues and, even safety issues.

All this adds up to higher overall maintenance costs, but these issues aren’t always easy to detect.

Let’s break down each of those items so you can see how the wrong approach to maintenance right affects them:

- Lower product quality: Let’s pretend you have a press with a loose belt. That loose belt will allow for small imperfections that will affect your products. Over time, you’ll start to disappoint customers who’ve come to expect a certain standard of excellence from your products.

- Higher energy costs: Imagine an HVAC system that rarely gets its air filters changed. Air does not flow through it as easily as it would through a clean filter. Because of this, the HVAC has to use more energy to pull the air in. According to the Department of Energy replacing a dirty filter with a clean one can reduce energy consumption by as much as 15%.

- Reduced asset lifespan: Imagine two cars. One car undergoes regular tire rotations and oil changes in addition to routine inspections. The other only goes to the shop when an obvious problem like a flat tire presents itself. You should expect the first car to last longer and perform better throughout that period. At Limble, our customers see an average increase in asset lifespan of 16%.

- Lost production hours: Poor maintenance causes more downtime. Downtime costs can vary from thousands to hundreds of thousands of dollars per hour. In manufacturing, for example, downtime is incredibly costly.

- Wasted resources: Poorly maintained equipment is hard to operate, produces defective products, and wastes a lot of time and management resources.

- Environmental issues: Poorly maintained equipment wastes energy, pollutes the environment, and could prove unhealthy for your employees.

- Safety risks: Poorly maintained equipment breaks down more often, sometimes unexpectedly. When equipment breaks down, it can increase your team’s risk of injury.

Free Essential Guide to CMMS

Discover everything you need to know about CMMS in this comprehensive guide. Begin your maintenance journey now!

The right way to think about maintenance costs

Many business owners have the wrong mindset when it comes to maintenance. They only see the department as a cost center, a business unit that doesn’t contribute strategic value. This leads them to pressure maintenance directors and managers to reduce total maintenance costs at all costs.

A more effective mindset views maintenance as an investment. By performing maintenance work you are not just spending money, you are investing in the long-term value of your equipment. You are spending money to increase the performance and useful life of your assets, to reduce production delays, and more.

Maintenance professionals will always need to work with a budget in mind. To have any chance at successfully managing maintenance expenditures, they need to understand which factors contribute to their maintenance bills and think strategically about using this budget effectively.

How do you calculate maintenance costs?

The real cost of an asset goes far beyond its purchase price. When a department is buying a new piece of equipment, it should also take into account ongoing maintenance and repair costs. The average cost of ongoing maintenance can significantly differ from one asset to another. How much regular maintenance it needs, how it handles wear and tear, and the cost of spare parts are just some of the factors that will impact annual maintenance costs for a given asset.

Those kinds of budgeting decisions are often left to maintenance directors and managers. At the end of the year, business owners will often focus on reviewing total costs, which are often represented as the total MRO (maintenance, repair, operations) costs on balance sheets.

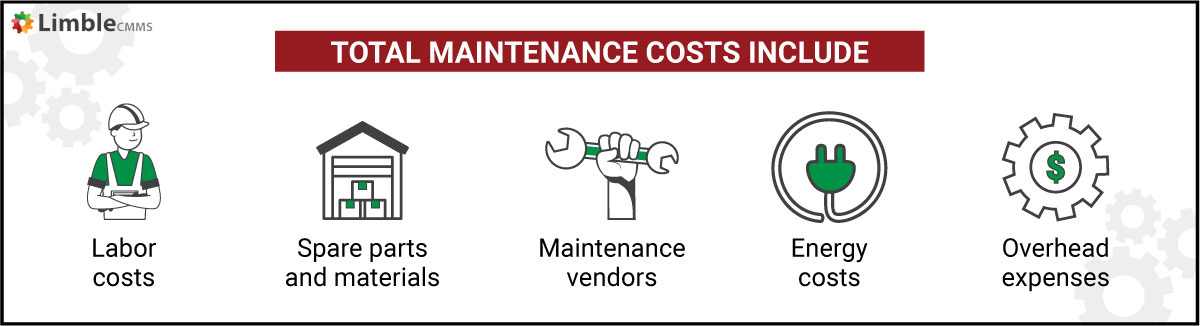

The MRO cost can be broken down into labor costs, spare parts and materials, maintenance vendors, energy costs, and overhead expenses. Effectively tracking costs for each of those categories is key for reducing future maintenance costs.

Some of the factors that go into calculating maintenance expenses.

Some of the factors that go into calculating maintenance expenses.

One important thing that often gets left out of this conversation is the indirect cost of lost productivity. During most maintenance activities, the asset has to be shut down. If scheduled maintenance or an unexpected repair happens during regular business hours, it will result in lost production hours – which means lost profit. Will the company lose hundreds or millions of dollars depends on how critical is the affected asset for business operations and the total length of equipment downtime.

Tracking maintenance expenses with Limble CMMS

One of the easiest ways to measure total maintenance costs is to use a CMMS software. The alternative is to spend hours digging through excel sheets, invoices, and old work orders whenever you have to create a report.

Tracking overall maintenance cost

To effectively manage maintenance costs, you need accurate data and the ability to break down costs into categories like parts and assets. This allows you to find and eliminate problem areas.

In Limble, total maintenance costs are broken down into three main categories:

- Money spent on parts

- Money spent on labor

- Money spent on outside vendors

This level of analysis is great for keeping an eye on overall maintenance costs. More granular reporting is necessary for pinpointing and executing on opportunities for improvement.

Tracking down expenses for a single asset

Vendor invoices are tied to assets. Spare parts are used on assets. Labor costs are incurred by performing maintenance work on assets. While a CMMS might allow you to break down costs based on types of invoices, types of spare parts, and type of performed work, the most useful reports will be those that look at specific assets.

Calculating an asset’s TCO without a CMMS

Imagine the world without a CMMS. To determine the total cost of ownership for an asset you would have to dig through digital files and paperwork to learn how much maintenance work has been performed on the asset and which spare parts have been used.

When you find that information, you have to hope it is accurate and that no work orders have been misplaced. After that, you’ll have to search through spreadsheets to find the cost for each spare part you’ve used.

Next, you need to look at who performed maintenance work, for how long, and if some of that work qualified as overtime.

See what you’re missing with Limble

Or you can use a digital solution like Limble and find all of that information with just a couple of clicks.

The easiest way to manage a maintenance budget is to gain in-depth insight into your data. When you know how much your assets cost you and why they break down it becomes much easier to find opportunities to cut costs and eliminate waste.

If you want to give Limble CMMS, you have three options:

More ways to decrease overall maintenance costs

It’s always hard to find new ways to shrink your maintenance budget. Below is an list with some additional ideas for reducing maintenance costs:

- Use an inventory management solution to accurately forecast inventory needs and decrease spare parts inventory costs

- Improve the onboarding process for machine operators, so they have less chance of damaging equipment through improper use and they feel committed to a culture of continuous improvement

- Negotiate with maintenance vendors and spare parts providers

- Implement lean maintenance practices to reduce all sources of waste

- Implement an autonomous maintenance program to maximize efficiency and minimize excess costs

- Invest in condition monitoring technology to monitor asset health and optimize your maintenance schedule

- Focus on proactive maintenance strategies like preventive maintenance and predictive maintenance

Maintenance costs vs. capital expenditures

For accounting purposes, it is important to distinguish between general maintenance costs and capital expenditures.

In short, regular maintenance costs relate to actions performed on a regular basis to keep assets in their original condition. This includes routine maintenance work, spare parts replacements, and simple repairs.

Capital expenditures are maintenance expenses like major overhauls and upgrades that require significant resource investments. Capital expenditures increase asset value.

The benefits of standard maintenance work last for less than 12 months and go on a profit and loss statement for the current year. In contrast, the benefits of capital expenditures last for more than 12 months. They may depreciate over time.

Sometimes you have to spend money to save money

Investing money in maintenance is often the smartest long-term solution you can make.

Of course, getting approval for such investments is easier said than done. The strongest case you can make to top management is to show the considerable return on investment of implementing a CMMS tool. Here’s a simple guide on how to calculate the ROI of your CMMS platform to help you get started.

Thanks i underattended Cost estimate

Comments are closed.